130K Followers & Growing

This is your chance to break ground with us and

We’re seeking Founding Members to help us

impact the entertainment industry and

support the next generation of artists.

Here’s how it works.

Our Reg A+ offering submitted to the SEC gives you opportunity to access our common shares. What does that mean? Simply put, the more money we make, the more you make – plus some extra perks (we’ll get into that later).

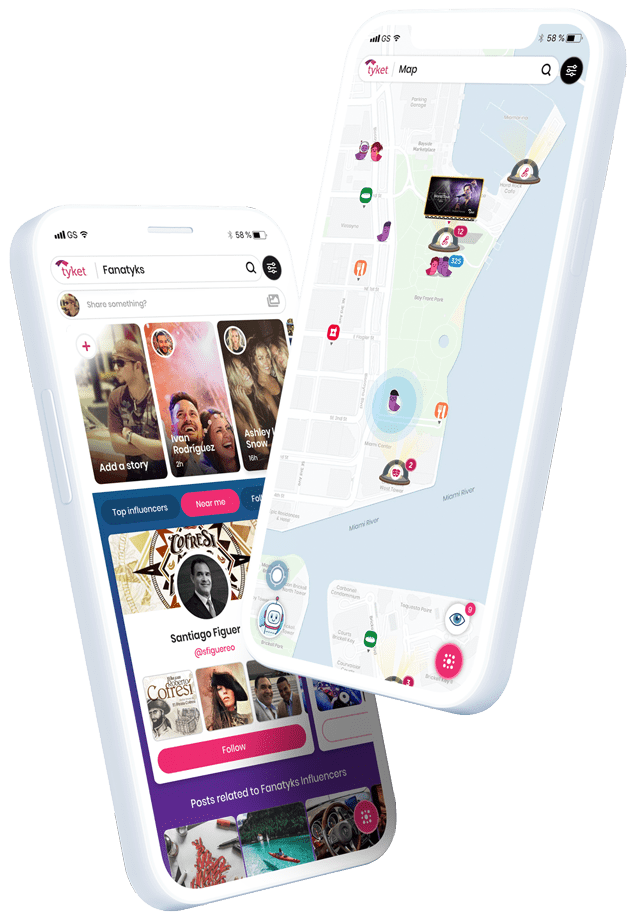

In order to proceed with our development plans, we’re looking to raise a maximum of $75 million. This will trigger the acceleration of our growth through increased marketing efforts, larger ticket inventories, faster mobile app production (Tyket), efficient talent recruitment, and funding the construction of our StageWood locations to be established in the biggest metropolitan areas.

Why Reg A+?

Regulation A+ offerings are intended to help small and medium-sized companies access capital that otherwise could not afford the costs of a normal SEC registration and allow non-accredited investors to participate in the offering.

Asking for startup donations to raise capital is ineffective because investors don’t feel like they’re genuinely participating in the company. Our Reg A+ offering is the best way to fairly compensate your belief in our mission by sharing the wealth with you as our Founding Member.

WE ARE HERE TO RESHAPE

THE ENTERTAINMENT INDUSTRY

We’re just starting our journey. With motivated individuals like you on board, we can really make a difference.

The following perks are reserved only for Founding Members who invest in StageWood. Introducing a new era of entertainment isn’t enough. We believe you should be rewarded for joining us from the start. For helping us reach our goals, Founding Members will receive:

• Access to all of StageWood’s exclusive events

• VIP passes to your favorite live events

• Higher presale priority for ticket purchases

• Meet-&-Greet opportunities with celebrities

• Opportunities to crowdfund incredible events

• Capital appreciation of the company’s shares & more!

YOU’RE NOT ONLY INVESTING IN IDEAS,

YOU’RE INVESTING IN PEOPLE!

Management Team

Santiago Figuereo

Founder & CEO

Damian Dechev

CTO

Asdrubal Martinez

CMO

Louis Silvestre

CBDO

OUR OFFERING

A BREAKDOWN OF YOUR INVESTMENT

StageWood intends to raise its first round of public funds via the Reg A+ equity stock offering. Once the SEC qualifies our offering, all shareholder investors will have the potential to receive these benefits:

- Capital appreciation of your shares in StageWood.

- A lifetime Founder membership status on Tyket, StageWood Events, and StageWood Facilities.

- Priority dividend distributions on realized profits on investments made by StageWood when declared by the corporation.

- Profound satisfaction from helping us reshape the entertainment industry to uplift artists, producers,

and most importantly – the fans.

Click the “Reserve Now” button to make a non-binding reservation in the name of StageWood Common Shares, and lock in the initial share price.

We accept investments via debit card, credit card, ACH, checks, wire transfers, Apple Pay, Google Pay, and from self-directed IRA accounts. We also accept investments in the form of Bitcoin and Ethereum.

Common Shares

15 Million

Minimum investment of

$500

Total offering of up to

75 Million

$5 per share

LEGAL DISCLAIMER

This internet site and the accompanying materials have been prepared by Stagewood Consortium, Inc. (“Stagewood”) solely for general informational purposes and do not constitute an offer to sell, the solicitation of an offer to purchase, or a recommendation for any securities by Stagewood or any third party. A securities offering by Stagewood is only being made pursuant to an offering circular that is part of Stagewood’s offering statement. An offering statement regarding this offering has been filed with the SEC. The SEC has qualified that offering statement which only means that the company may make sales of the securities described by that offering statement. It does not mean that the SEC has approved, passed upon the merits or passed upon the accuracy or completeness of the information in the offering statement. Neither has any other governmental agency passed upon the merits or the accuracy or completeness of the information in the offering statement. The securities offered by Stagewood are highly speculative. Investing in Stagewood’s securities involves significant risks and may result in partial of total loss of your investment. The investment is suitable only for persons who can afford to lose their entire investment. Furthermore, investors must understand that such investment could be illiquid for an indefinite period of time. No public market currently exists for the securities, and if a public market develops following the offering, it may not continue. You may obtain a copy of the Form 1-A offering circular that is part of said offering statement here. You should read the offering circular before making any investment. The content of this internet site is qualified in its entirety by such offering circular.